Key Takeaways:

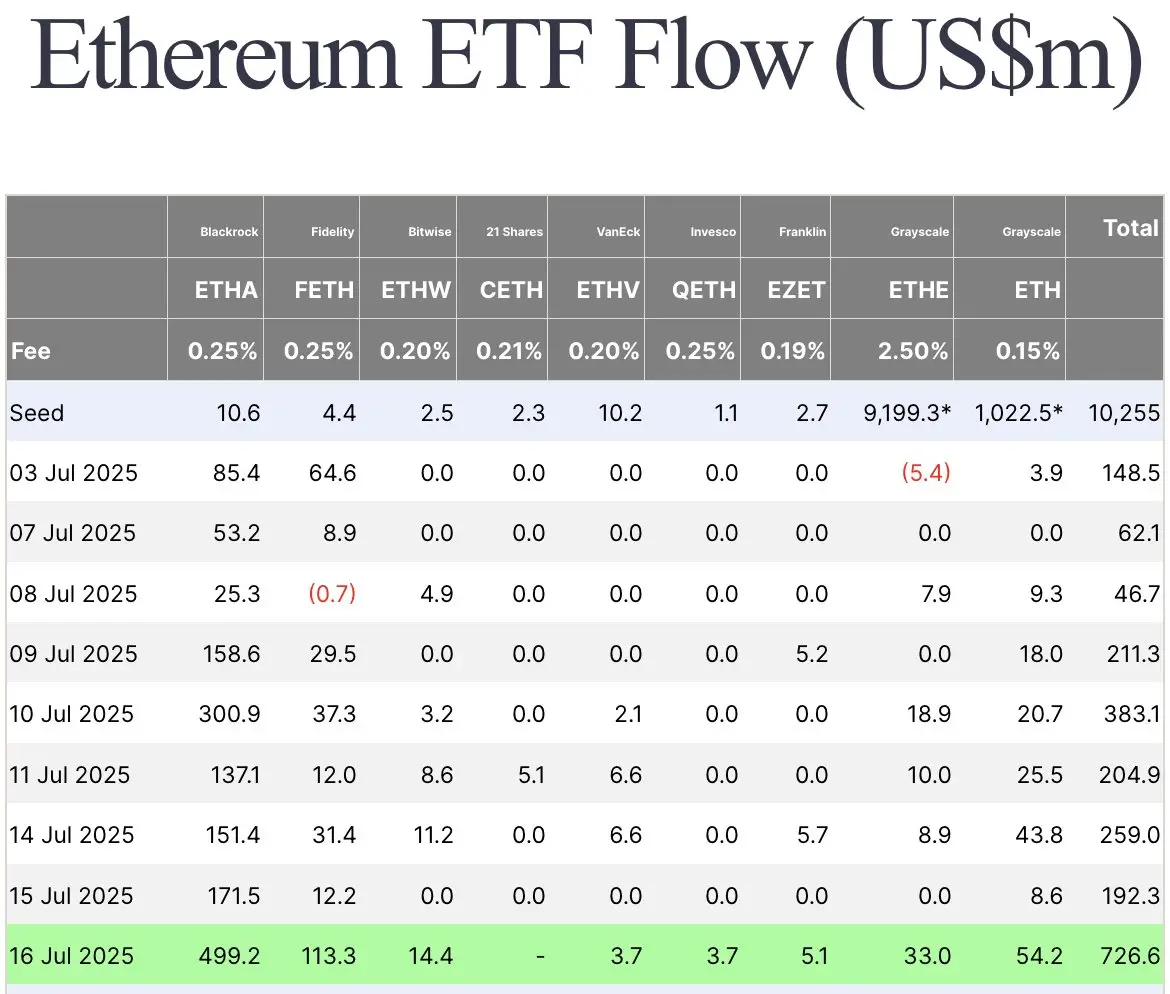

- Record ETF Interest: Spot Ethereum ETFs reported daily net inflows of $726.74 million on Wednesday (July 16, 2025) an unprecedented high.

- Surging Price: ETH jumped over ~8%, trading around $3,440 as of writing, recording the highest price level since mid-January.

- Technical Heat: Overbought conditions reflect recent RSI readings, ranging from 70 to 80, suggesting chances of near-term pullback.

Ethereum saw a notable rally in the 24 hours amid surging institutional demand, clearing up its pathway to $3,400 levels fueled by the cumulative $726.7 million net inflows recorded by spot Ethereum exchange-traded funds (ETFs). This is by far the largest single-day increase since their inception, with its funds including BlackRock’s iShares Ethereum Trust, which contributed around $499 million. check out our new artice about bitcoin vs ethereum

Meanwhile, analysts on X and crypto news outlets noted the continuous surge of the second most popular cryptocurrency followed by the massive daily net inflow recorded by spot Ethereum ETFs as a tipping point. A post on X from Lark Davis emphasized:

Largest day ever for $ETH ETF inflows with $726 million. Institutions, treasury companies, and smart money is accumulating ETH like never before… Send it to $4,000 with haste!

So far in July, a total of approximately $2.27 billion has been recorded in ETH ETF inflows according to The Block the highest monthly figure since the ETF's launch in July 2024.

Rachael Lucas, crypto analyst at BTC Markets, noted:

Ethereum is increasingly being seen as a long-term institutional asset, not just a trading vehicle... Combine that with more than US$2.5B in daily trading volume, bullish chart setups, and capital rotation out of bitcoin, and you've got a breakout that’s being driven by both fundamentals and sentiment.

Market and Price Impact

ETH seems to be plotting a comeback after months of trading around $2,000. The token surged from sub-$3,300 to ~$3,460, gaining ~7.5% in 24 hours. Intraday range: $3,147–$3,455.

Daily charts from platforms like AltIndex and RSI Hunter report RSI levels between 72 and 80, placing ETH in overbought territory.

All major short- and long-term moving averages (5- to 200-day) are aligned bullishly, confirming strong upward momentum. Despite short-term overheating, the inflows suggest growing institutional confidence in ETH as a long-term asset.

Any near-term pullback might offer strategic entry opportunities for long-term investors.

Summary

Ethereum surged past $3,400 after spot Ethereum ETFs registered $726 million in a single day the highest daily inflow since launch. BlackRock’s iShares ETH Trust alone contributed nearly $500M. ETH is up ~8%, trading around $3,440, with RSI readings between 70–80 indicating overbought conditions. Analysts cite growing institutional interest, bullish momentum, and a shift in capital from Bitcoin. While a short-term pullback is possible, long-term fundamentals remain strong, positioning ETH as an increasingly strategic holding.