Key Takeaways:

- SOL saw a significant 24H price surge following ETF speculations along with the announcement of Jito’s Block Assembly Marketplace

- A noticeable increase of institutional inflows into SOL, reaching approximately $40 million this week has been reported, with ETF vehicles like VanEck and REX-Osprey drawing significant pre-commitments.

- Technical indicators such as a golden cross and bull flag breakout above key moving averages, suggests further rally toward $220-300 mark.

Solana’s recent breakout has continued to rip through the $200 resistance level, recording a significant gain of ~12% in a single day, fueled by ETF rumors and ecosystem enhancement.

As of this writing, SOL is trading near $190-$203.56 in the last 24 hours, according to CoinGecko's latest market data. After a significant 12% rise, Solana was seen trading around $203 as of today (July 22, 2025 06:36 UTC), marking a major growth in investor appetite and confidence, strengthening liquidity, and renewed interest in the Solana ecosystem.

Solana 12% Rally Cause

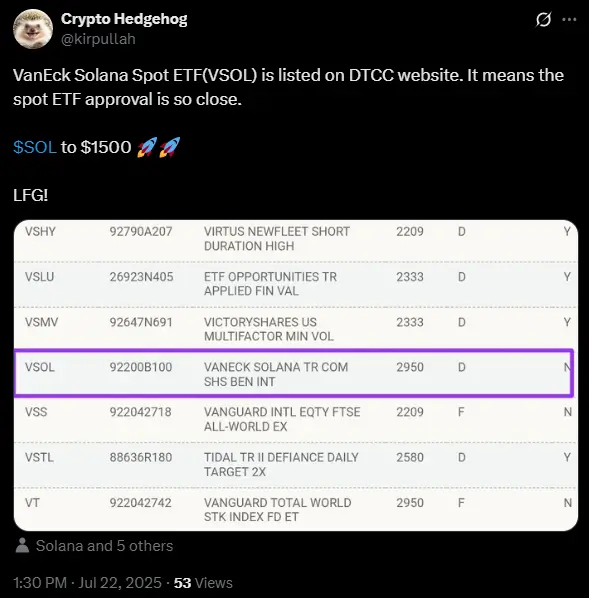

A recent post in X (formerly Twitter) confirms VanEck Solana Spot ETF (VSOL) is officially listed on DTCC (Depository Trust and Clearing Corportation) website, adding to the excitement and fueling hope of nearing U.S. approval.

This listing is often interpreted as a key step before approval, adding certainty of being approved in the soonest time possible. Though still a wide speculation, CoinPedia sees this as something that gives a “breakout signal” to traders and investors.

On the other hand, REX-Osprey’s spot SOL ETF reportedly attracted $73 million in inflows, according to a CoinDesk report.

Meanwhile, Solana’s ecosystem upgrade also served as a key driver that fueled its 12% 24H boost, with its highly anticipated launch of Block Assembly Marketplace (BAM). This marketplace ensures improvement of transaction speed and increased privacy on the Solana network. While being expected to attract both retail and institutional investors, analysts, particularly from CoinDesk, suggests that this ecosystem enhancement added to the bullish narrative of SOL.

Nick Ruck, director at LRVG Research, noted:

Investors were bullish as the development would greatly enhance the efficiency of Solana transactions with more privacy and flexibility…” emphasizing the uptrend gestures of the coin amid its ecosystem upgrade.

Moreover, Vincent Liu, CIO at Kronos Research, highlighted the strong points of Solana breaking the $200 barrier, noting that it “indicates a resurgence of investor confidence and increased market liquidity.

Price and Market Impact

While currently trading around roughly $197.78, Solana is still at its bullish sentiment momentum, thanks to its two main pillars; SOL ETF buzz and Jito’s BAM hype, which brought excitement and renewed hope for this coin’s uptrend.

Meanwhile, based on the recent RSI readings from CryptoWaves, at approximately 77.02 (4H) and 80.59 (24H), it indicate overbought conditions. While a classic golden cross was observed (50MA moving past 200MA) suggests bullish momentum. These two factors added as confluences on Solana’s drive on its way to $300 mark.

Besides a technical milestone for its dramatic rebound of $200, the recent Solana’s rally is also a sign of shifting market sentiment. An ETF rumor and protocol enhancement serve as the foundation that supports the rally, making SOL poised for further value increase.

Summary

Solana (SOL) surged over 12% in 24 hours, reclaiming the $200 mark for the first time since February. The rally was driven by mounting speculation around spot Solana ETFs specifically VanEck’s listing on DTCC and the launch of the Jito Block Assembly Marketplace (BAM), which promises improved privacy and transaction efficiency. SOL reached a high of ~$203 before stabilizing. Analysts see further upside supported by technical indicators like a golden cross and strong RSI readings. Institutional inflows nearing $40–73 million suggest growing market confidence and renewed momentum for Solana.