Key Takeaways:

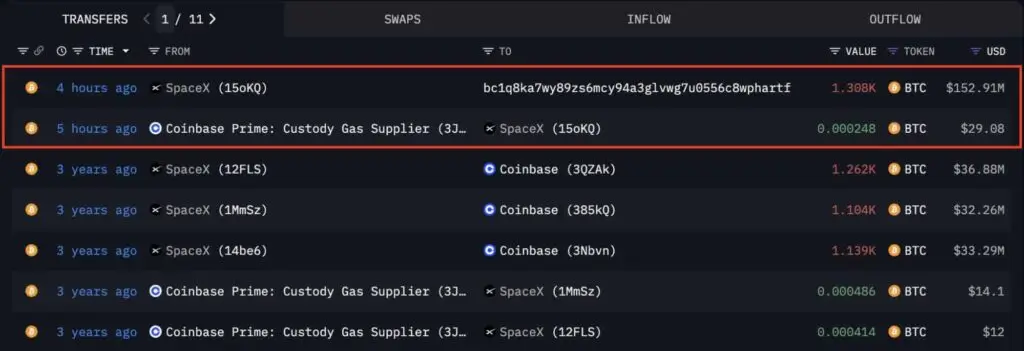

- SpaceX moves exactly 1,308 BTC to a wallet address with a last on-chain activity since June 10, 2022, marking its first-time-in-3-years transaction gestures.

- Moving the $153 million worth of BTC to a newly active wallet suggests a cold wallet reallocation rather than a sale.

- SpaceX currently holds 6,977 BTC with equivalent over $825 million, considered as one of the top corporate Bitcoin hoards.

- Bitcoin trades around $118,859 with no significant price reaction since the noticeable wallet transfer.

Aerospace manufacturer and space transportation company SpaceX has recently made a surprising move in the cryptocurrency market, moving 1,308 BTC from a wallet tagged to the company to a new, 3-years inactive address on July 22. This data report from Arkham marks the first on-chain transaction of the formerly inactive crypto wallet since June 2022, recalling when it move 3,505 BTC to Coinbase.

Totaling up to roughly $153 million, this massive crypto transaction was not officially announced by SpaceX, as well as the reason for moving the Bitcoin, leaving everyone clueless and curious about the company’s purpose of this on-chain activity. Moreover, there is no official comment or announcement made by the company’s CEO Elon Musk.

However, Arkham’s recent data report shows SpaceX now holds roughly 6,977 BTC valued at $825 million after the latest transaction to the dormant Bitcoin wallet.

Was this a selloff or strategy shift?

As of this writing, no clear evidence or report shows that BTC was transferred to a crypto exchange, which emphasizes that the recent transaction is unlikely a sell-off.

Meanwhile, Arkham’s data and market analysis platforms like CoinDesk and Mitrade suggests that the move is likely a cold-storage reallocation, a commonly used move for treasury security or internal cash management, making it a gesture with no immediate impact on Bitcoin’s price.

Industry analysts also interpret that this move is more on the purpose of internal accounting, auditing, or to enhance security protocols. A blockchain analyst from Mitrade also highlighted what likely to be the company’s purpose of such transaction.

It’s highly probable that this was just a custody migration or routine treasury rebalancing,” said the Mitrade analyst. “If SpaceX was liquidating, we’d expect follow-up transactions to exchange wallets or OTC desks, which haven’t been observed so far. he added.

Market Impact

Despite the large transfer, the crypto market has shown little immediate reaction, likely due to the nature of the move and the lack of signs pointing toward liquidation.

As of writing, BTC is trading at roughly $118,859, with a 24H decrease of 0.25%. The token’s current price is in slight correction form last week’s high of $122,000, which indicates a phase of consolidation.

Meanwhile, Bitcoin’s Relative Strength Index (RSI) plays around ~55 (4H) and ~67 (24H) acccording to CryptoWaves, suggesting neutral momentum.

The company’s recent move emphasizes the increasing adaptation and integration of cryptocurrencies by major companies. SpaceX, lead by Elon Musk, while continuously setting the standard to technological innovation, also contributes in demonstrating the potential of digital currencies with their involvement to Bitcoin.

Summary

SpaceX made its first on-chain Bitcoin transaction in three years, transferring 1,308 BTC (worth $153 million) to a newly active address. Data from Arkham suggests this was not a sale but a reallocation to a cold wallet. SpaceX now holds 6,977 BTC ($825M), placing it among the top corporate Bitcoin holders. Market analysts interpret the move as part of internal security or treasury rebalancing. Despite the large amount, Bitcoin’s price remained stable around $118,859. The activity underscores SpaceX’s long-term crypto positioning without signaling immediate liquidation.